Is a Bridging Loan Worth It?

In the current market where property prices are trending higher and there’s a shortage of stock, upgraders and downgraders can find it difficult to get into a new property. For many, the age-old question of whether to buy first or sell first is more prominent than ever with the present housing market favouring sellers.

Fortunately, there is an option that can help in the form of a bridging loan. A bridging loan is a short-term loan that helps buyers purchase a property before needing to sell their current property.

In a perfect world, you would sell your property and then go out and find a new property. However, if the perfect home comes along beforehand, you might not want to miss out on the opportunity. That said, there are advantages and disadvantages to bridging loans.

Advantages

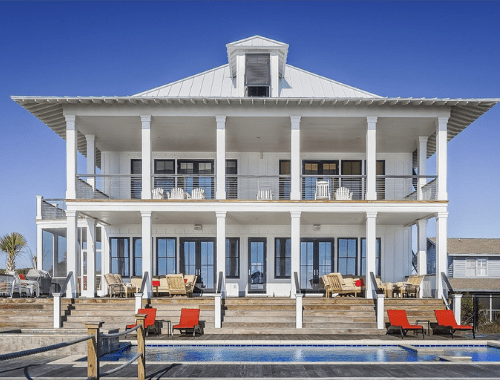

The main benefit of a bridging loan is that you can buy a property right away. You don’t have to wait for the property to sell or even to settle, which can be a long time in some instances. It will also give you room to sell your property, so you aren’t forced to sell immediately at a worse price than you might have received otherwise.

When you take out a bridging loan, it is normally an interest-only loan, where you pay back all the interest at the end when you sell your original property. With this type of loan, you’re only needing to pay back one mortgage at a time and can pay off all the accrued interest when you sell and settle on your current property.

In years gone by, bridging loans weren’t as appealing as they often came with very high interest rates. These days many lenders will offer standard variable rates, but as always, policies differ between lenders and products.

Disadvantages

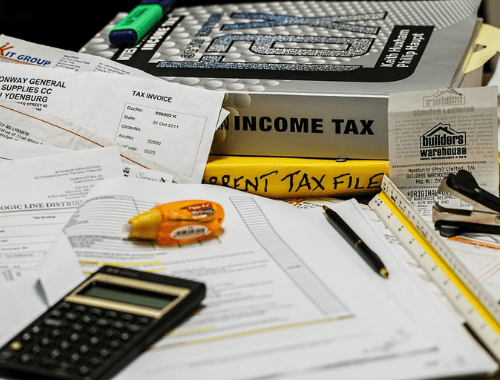

When you are taking on a bridging loan you are technically carrying two properties and therefore will be paying interest on both. The longer it takes to sell your current property the more interest you will be required to pay. Some lenders might even force you to pay higher interest rates after a set period of time.

There are certain areas where you will need to pay additional costs when using a bridging loan. For example, given that you have two properties, you will need to pay for two valuations. There can also be costs involved with breaking your current loan to take on a bridging loan.

To qualify for a bridging loan, you still need to be able to service the total amount of debt based on your income and expenses. In some ways, this is similar to getting an investment loan. You will also need to have a reasonable amount of equity built up in your current home.

If you have a question or would like more information, please contact…

Steve

Mobile 0423 894 864

steve@bettermoneylenders.com.au

Brett

Mobile 0428 156 680

brett@bettermoneylenders.com.au