House prices to increase by as much as 12% in 2022

After a stellar 12 months where property prices rose 22.1 per cent across the country, the momentum is expected to continue into 2022.

The latest PropTrack Property Market Outlook 2022 from REA notes that some capital cities could see growth as high as 12 per cent, giving homeowners more gains to look forward to.

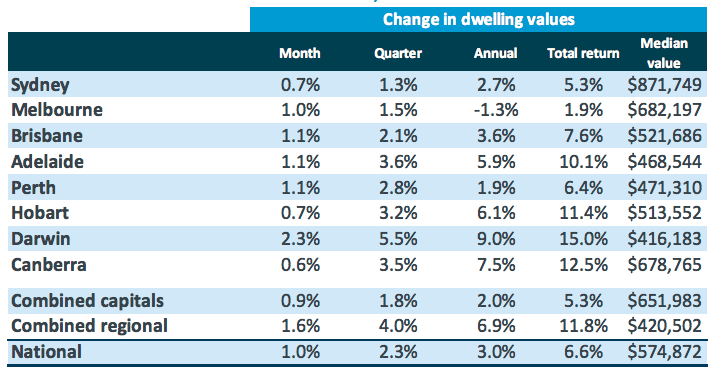

According to the report, homeowners in Hobart (9–12 per cent predicted growth), Brisbane (8–11 per cent), Adelaide (6–9 per cent) and Canberra (6–9 per cent) stand to be the big winners this year, as low interest rates and robust demand keep the housing market drifting higher.

REA Group’s Executive Manager of Economic Research, Cameron Kusher, said that some of the smaller capital cities are continuing to outperform at the moment.

“Brisbane and Hobart have the strongest price growth forecasts among the capital cities thanks to their low supply of stock for sale, heightened demand and relatively lower prices compared to Sydney and Melbourne,” he said.

The report also predicts property prices will increase in Perth (3–6 per cent), Sydney (4–7 per cent), Melbourne (4–7 per cent) and Darwin (5–8 per cent).

“Perth has shown a stronger slowdown in price growth already relative to other capital cities, while the more expensive property prices in Sydney and Melbourne may increasingly see demand shift to more affordable housing markets.”

According to Mr Kusher, the overall rate of growth won’t be as high as what we experienced in 2021 as more listings hit the market, giving buyers greater choice.

“The recent lift in new listings should go some way to allow more buyers to find a home,” he said.

“After that, the question will be … how large is the next wave of buyers? We believe this next wave is likely to be big, but not as large as the current one, so that should result in a better supply and demand balance.”

“We expect a smaller wave of buyers because prices have increased, rapidly pricing some buyers out.”

Mr Kusher also expects some changes to the property market with the return of international travel.

“With investors returning to the market and credit tightening having commenced, we may see a pick-up in demand and price growth for units relative to houses over the coming years. Especially given their prices are now significantly lower than the price of a house.”

“Other factors such as the reopening of international borders and the return of migrant workers and international students may add to demand.”

“Inner-city living also became relatively less attractive to many while COVID lockdowns and other restrictions were in place, as the economy reopens and the CBD springs back to life, this trend may reverse somewhat.”

If you have a question or would like more information, please contact…

Steve

Mobile 0423 894 864

steve@bettermoneylenders.com.au

Brett

Mobile 0428 156 680

brett@bettermoneylenders.com.au