Getting Into the Property Market Sooner

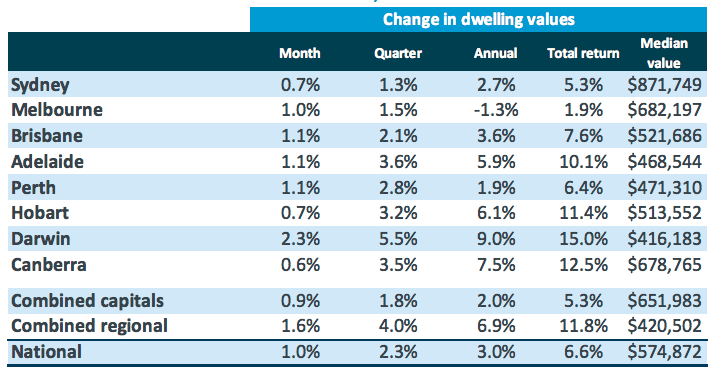

With house prices rising sharply it’s growing more difficult for homebuyers to come up with a deposit.

Fortunately, there are options out there that allow people to purchase a property without needing to save the traditional 20 per cent deposit that lenders look for.

Lender’s Mortgage Insurance (LMI)

If you’re unable to come up with the full deposit, it could be worth considering Lender’s Mortgage Insurance (LMI). LMI is a premium that is put in place to help protect the lender in the event the borrower is unable to manage their repayments.

LMI allows borrowers to take out a loan with a lender when they have a deposit of less than 20 per cent. The rate of LMI that a borrower is required to pay changes based on the amount of the loan, the property’s location and how far off the 20 per cent deposit the borrower is.

The main advantage of a tool such as LMI is that it allows buyers to get into the market sooner. This is especially relevant when prices are rising rapidly like we’ve seen in recent years, as it can mean a homebuyer is able to purchase a property earlier than they might have otherwise been able to.

If it takes a homebuyer two to three years to save up the required deposit, property prices in their favoured location might have moved beyond their reach.

Federal Government Schemes

If you’re a first home buyer, you may have other options worth exploring that will allow you to buy sooner while avoiding LMI altogether.

The latest Federal Budget has seen the First Home Loan Deposit Scheme expanded and rebadged as the Home Guarantee Scheme. Under the scheme, the Federal Government effectively acts as a guarantor for the first home buyer’s deposit shortfall.

There are certain criteria that first home buyers must meet, but the program allows you to purchase a property with as little as a five per cent deposit. You will still need to meet serviceability requirements.

Another family home guarantee scheme for single parents works in a similar fashion and allows people to purchase a home with just a two per cent deposit.

The latest budget also included assistance for those looking to purchase in regional areas.

Under the scheme, you must be purchasing a new home in a regional location and have not owned a home for at least five years. Under this program, you don’t have to be a first home buyer.

Guarantor Loan

The final way to get into a home sooner is with the assistance of family. A guarantor loan works by using the equity in a family member’s home as the shortfall for your deposit.

This is for first home buyers who can use the equity in their parent’s home to help them grab a rung on the property ladder.

If you have a question or would like more information, please contact…

Steve

Mobile 0423 894 864

steve@bettermoneylenders.com.au

Brett

Mobile 0428 156 680

brett@bettermoneylenders.com.au